Introduction

Asset Capitalization is the process of creating an asset by bringing together various stock items or services or other assets purchased specifically for its construction. It involves aggregating costs and converting them into a tangible or intangible asset that can be tracked, depreciated, and utilized over time.

ERPNext offers a robust and user-friendly framework to handle both these processes. In this blog, we’ll explore the concepts of asset capitalization and uncapitalization, their significance, and how ERPNext facilitates efficient management of these critical accounting tasks.

Why is Capitalization Important?

- Accurate Financial Reporting: Ensures that the balance sheet and income statement reflect the true financial health of the business.

- Regulatory Compliance: Aligns asset management with accounting standards like IFRS or GAAP.

- Tax Implications: Helps businesses maximize allowable deductions through depreciation.

- Operational Clarity: Provides better insight into how assets contribute to business performance.

How ERPNext Handles Asset Capitalization

ERPNext provides a streamlined process for asset capitalization, enabling businesses to aggregate costs of stock items and services into a single composite asset. This ensures accurate financial representation and simplified tracking of constructed or internally built assets.

Example Workflow:

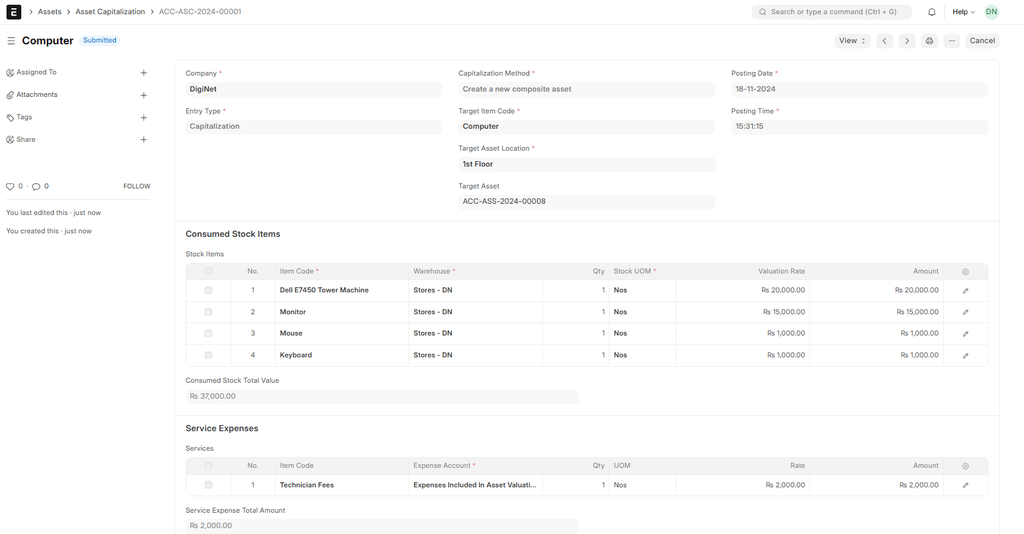

In the example below, a computer asset is capitalized by combining stock items and service expenses.

- Stock Items Consumed:

- Four stock items are utilized:

- Dell E7450 Tower Machine (Rs. 20,000)

- Monitor (Rs. 15,000)

- Mouse (Rs. 1,000)

- Keyboard (Rs. 1,000)

- These items are selected from inventory and assigned a valuation rate and total amount, contributing to the final asset cost.

- Service Expenses Added:

- Additional costs, such as technician fees (Rs. 2,000), are included under Service Expenses.

- The expense account categorizes these costs as part of the asset's value.

- Target Asset Creation:

- All costs are aggregated to create a new composite asset, in this case, a computer, valued at Rs. 37,000 (stock) + Rs. 2,000 (service) = Rs. 39,000.

- Posting Details:

- The capitalization is posted with accurate dates and times, ensuring accurate records in the Asset module.

This approach allows organizations to track detailed costs while maintaining financial clarity, offering a clear audit trail and simplifying asset depreciation management.

Screenshot of ERPNext V15 Asset Captalizaiton Document.

Conclusion

Asset capitalization are vital processes for maintaining accurate financial records and making informed business decisions. ERPNext offers a seamless, transparent, and efficient way to manage these processes, ensuring compliance with accounting standards and operational clarity.

Are you ready to take control of your assets? Explore ERPNext’s Asset Module today to simplify your accounting processes and optimize your asset management strategy.

Rizwan Ahmed

Certified ERPNext Functional Consultant

No comments yet. Login to start a new discussion Start a new discussion