Automated Taxes via Tax Rules

ERPNext Tax Rule is an important feature for handling complex business scenario with automated tax application in business transactions.

Introduction:

In many industries and regions, tax rates depend on various conditions such as the origin of goods, type of product, or customer category. Manually tracking and applying the correct tax rates in transactions can be a time-consuming and error-prone process. ERPNext addresses this challenge with its Tax Rule feature, which automates tax calculations based on predefined conditions. In this blog, we’ll explore how ERPNext simplifies tax management with a practical example of importing items from different countries with varying tax rates.

Scenario:

Imagine you are importing Item A from two different suppliers:

- Supplier A from the US, where the applicable tax rate is 10%.

- Supplier B from India, where the applicable tax rate is 6%.

Without automation, you would need to manually adjust the tax rate in your purchase orders based on the supplier's origin. This not only increases the risk of errors but also consumes valuable time.

ERPNext’s Tax Rule feature eliminates this hassle by automatically applying the correct tax rate based on the supplier’s location.

How ERPNext Tax Rules Work:

ERPNext allows you to define Tax Rules that automatically apply the appropriate tax rate based on conditions such as:

- Supplier location (country, state, or region)

- Item tax category

- Customer tax category

- Transaction type (purchase, sales, etc.)

By setting up these rules, you can ensure that the correct tax rate is applied without manual intervention.

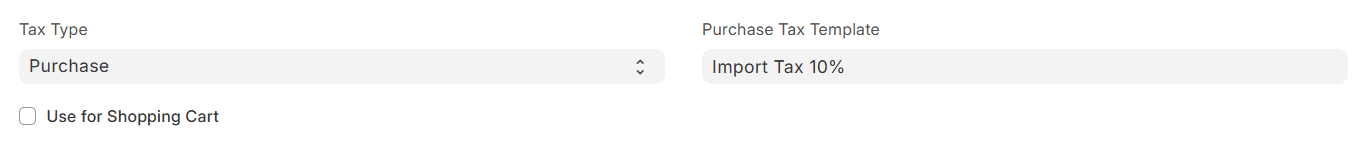

For US:

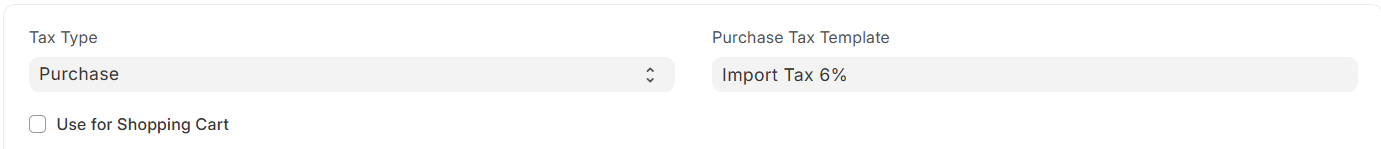

For India:

Once the tax rules are set up, ERPNext will automatically apply the correct tax rate when creating a purchase order. This can be observed in the GIF below:

Conclusion:

Managing taxes manually can be a daunting task, especially when tax rates vary based on multiple conditions. ERPNext’s Tax Rule feature simplifies this process by automating tax calculations based on predefined rules. In our example, we saw how ERPNext can automatically apply different tax rates for the same item imported from different countries, ensuring compliance and reducing manual effort.

By leveraging ERPNext’s Tax Rules, businesses can:

- Save time by eliminating manual tax adjustments.

- Reduce errors in tax calculations.

- Ensure compliance with tax regulations.

- Streamline operations and focus on core business activities.

Whether you’re dealing with imports, exports, or domestic transactions, ERPNext’s Tax Rules provide a flexible and efficient solution for managing taxes. Start automating your tax calculations today and experience the ease of doing business with ERPNext!

Rizwan Ahmed

Certified ERPNext Functional Consultant

No comments yet. Login to start a new discussion Start a new discussion